Ratios are quantitative measures used in financial analysis to evaluate various aspects of a company’s performance, financial health, and operational efficiency. These ratios are calculated by dividing one financial metric by another, providing insights into the relationship between different financial elements. Ratios are essential for several reasons:

- Performance Evaluation: Ratios allow stakeholders to assess a company’s financial performance over time, comparing current ratios to historical data or industry benchmarks. This evaluation helps identify trends, strengths, weaknesses, and areas for improvement.

- Financial Health Assessment: Ratios provide valuable information about a company’s financial health, including its liquidity, solvency, and profitability. By analyzing these ratios, stakeholders can gauge the company’s ability to meet its short-term and long-term financial obligations.

- Decision-Making: Ratios assist in decision-making processes for investors, creditors, managers, and other stakeholders. Investors use ratios to make investment decisions, while creditors use them to assess creditworthiness. Managers use ratios to identify areas needing improvement and make strategic decisions.

- Comparative Analysis: Ratios facilitate comparisons between companies within the same industry or sector. Benchmarking against industry peers helps identify competitive advantages or areas where a company may be underperforming relative to its competitors.

- Forecasting and Planning: Ratios provide valuable insights for financial forecasting and planning. By analyzing historical trends and projecting future performance based on current ratios, companies can develop strategic plans and set realistic financial goals.

- Communication Tool: Ratios serve as a common language for financial communication among stakeholders. They help convey complex financial information in a concise and understandable manner, facilitating communication and collaboration between different parties.

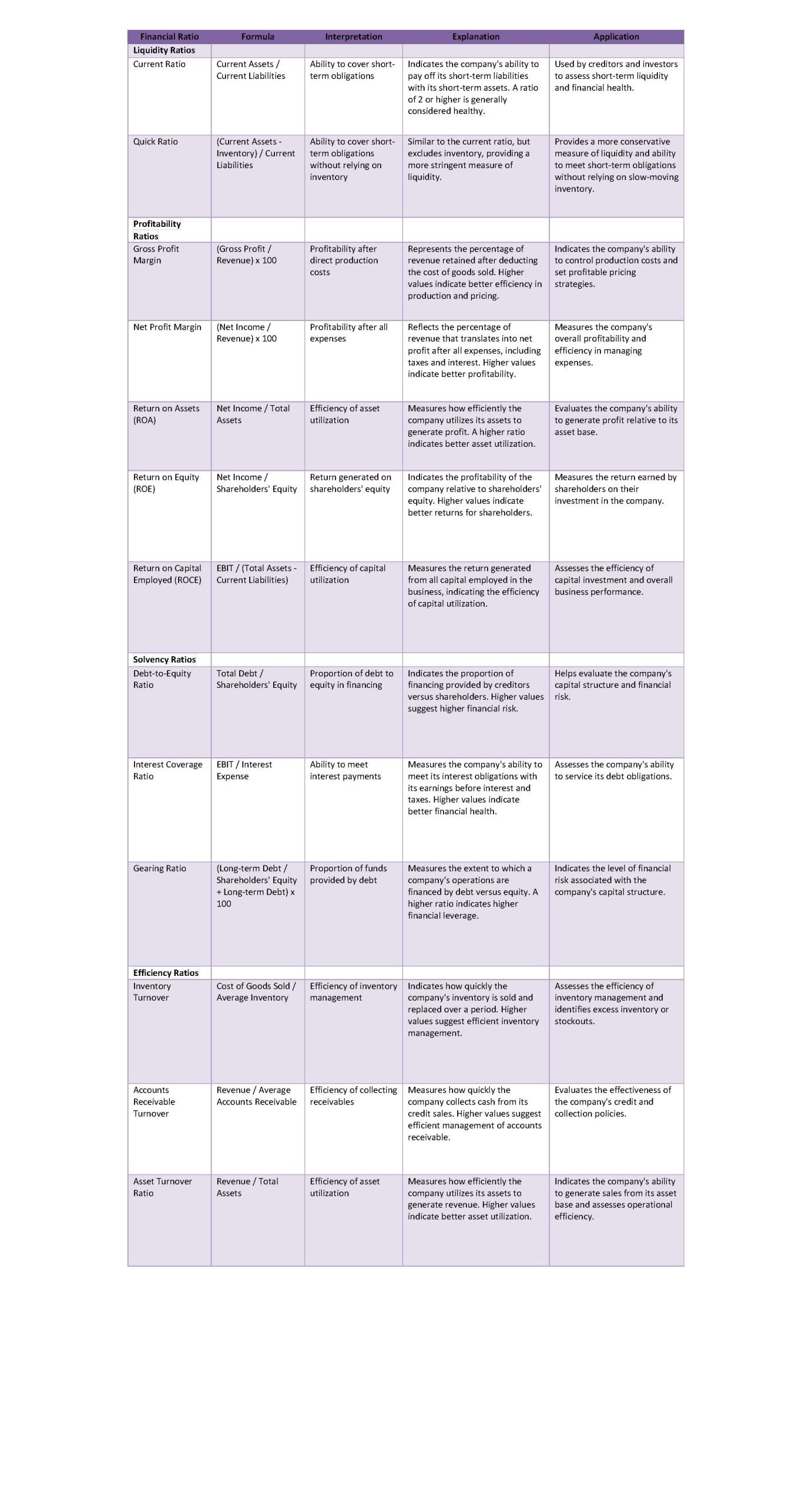

Below are some key financial ratios:

Liquidity Ratios

- Current Ratio: Current Assets / Current Liabilities

- Interpretation: Measures the company’s ability to cover short-term obligations.

- Explanation: Indicates the company’s ability to pay off its short-term liabilities with its short-term assets. A ratio of 2 or higher is generally considered healthy.

- Application: Used by creditors and investors to assess short-term liquidity and financial health.

- Quick Ratio: (Current Assets – Inventory) / Current Liabilities

- Interpretation: Measures the ability to cover short-term obligations without relying on inventory.

- Explanation: Similar to the current ratio, but excludes inventory, providing a more stringent measure of liquidity.

- Application: Provides a more conservative measure of liquidity and ability to meet short-term obligations without relying on slow-moving inventory.

Profitability Ratios

- Gross Profit Margin: (Gross Profit / Revenue) x 100

- Interpretation: Represents the percentage of revenue retained after deducting the cost of goods sold.

- Explanation: Indicates the company’s ability to control production costs and set profitable pricing strategies.

- Application: Measures the company’s overall profitability after direct production costs.

- Net Profit Margin: (Net Income / Revenue) x 100

- Interpretation: Reflects the percentage of revenue that translates into net profit after all expenses.

- Explanation: Reflects the company’s overall profitability and efficiency in managing expenses.

- Application: Measures the company’s overall profitability after all expenses, including taxes and interest.

- Return on Assets (ROA): Net Income / Total Assets

- Interpretation: Measures how efficiently the company utilizes its assets to generate profit.

- Explanation: Evaluates the company’s ability to generate profit relative to its asset base.

- Application: Assesses the efficiency of asset utilization and the company’s profitability relative to its asset base.

- Return on Equity (ROE): Net Income / Shareholders’ Equity

- Interpretation: Indicates the profitability of the company relative to shareholders’ equity.

- Explanation: Measures the return earned by shareholders on their investment in the company.

- Application: Measures the return generated on shareholders’ equity and indicates how effectively the company is using shareholders’ funds.

- Return on Capital Employed (ROCE): EBIT / (Total Assets – Current Liabilities)

- Interpretation: Measures the return generated from all capital employed in the business.

- Explanation: Assesses the efficiency of capital investment and overall business performance.

- Application: Indicates the efficiency of capital utilization and helps evaluate the company’s financial performance relative to the capital employed.

Solvency Ratios

- Debt-to-Equity Ratio: Total Debt / Shareholders’ Equity

- Interpretation: Indicates the proportion of financing provided by creditors versus shareholders.

- Explanation: Helps evaluate the company’s capital structure and financial risk.

- Application: Assesses the company’s capital structure and financial risk by comparing the proportion of debt and equity financing.

- Interest Coverage Ratio: EBIT / Interest Expense

- Interpretation: Measures the company’s ability to meet its interest obligations with its earnings before interest and taxes.

- Explanation: Assesses the company’s ability to service its debt obligations.

- Application: Helps evaluate the company’s ability to meet its interest obligations and assess its financial health.

- Gearing Ratio: (Long-term Debt / Shareholders’ Equity + Long-term Debt) x 100

- Interpretation: Measures the extent to which a company’s operations are financed by debt versus equity.

- Explanation: Indicates the level of financial risk associated with the company’s capital structure.

- Application: Helps assess the company’s financial risk and the proportion of funds provided by debt relative to equity.

Efficiency Ratios

- Inventory Turnover: Cost of Goods Sold / Average Inventory

- Interpretation: Indicates how quickly the company’s inventory is sold and replaced over a period.

- Explanation: Assesses the efficiency of inventory management and identifies excess inventory or stockouts.

- Application: Helps evaluate the efficiency of inventory management and optimize inventory levels.

- Accounts Receivable Turnover: Revenue / Average Accounts Receivable

- Interpretation: Measures how quickly the company collects cash from its credit sales.

- Explanation: Evaluates the effectiveness of the company’s credit and collection policies.

- Application: Assesses the efficiency of accounts receivable management and cash collection process.

- Asset Turnover Ratio: Revenue / Total Assets

- Interpretation: Measures how efficiently the company utilizes its assets to generate revenue.

- Explanation: Indicates the company’s ability to generate sales from its asset base and assesses operational efficiency.

- Application: Helps evaluate the efficiency of asset utilization and assess the company’s operational performance relative to its asset base.